Microsoft Advertising Bing Ads & Google AdWords Pay Per Click Coupons that Work in April 2024

Save Over $100 In The Next 5 Minutes

Microsoft Advertising (also known as Bing Ads): get a free Bing coupon today to run PPC advertisements on Bing, Yahoo! Search, AOL & other Bing partners across their search network.

Are you from the United States? Use this $100 coupon.

Are you from the United States? Use this $100 coupon.  Are you from Canada? Use this $50 coupon.

Are you from Canada? Use this $50 coupon. Are you from the UK? Use this £50 vouchers.

Are you from the UK? Use this £50 vouchers. Are you from Germany? Use this €75 coupon.

Are you from Germany? Use this €75 coupon. Are you from France? Use this €50 coupon.

Are you from France? Use this €50 coupon. Are you from Italy? Use this €50 coupon.

Are you from Italy? Use this €50 coupon. Are you from Spain? Use this €50 coupon.

Are you from Spain? Use this €50 coupon. Are you from Australia? Use this $50 coupon.

Are you from Australia? Use this $50 coupon. Are you from New Zealand? Use this $50 coupon.

Are you from New Zealand? Use this $50 coupon. Are you from India? Use this ₨1000 coupon.

Are you from India? Use this ₨1000 coupon.  Are you from Mexico? Use this $670 coupon.

Are you from Mexico? Use this $670 coupon. Are you from Brazil? Use this R$150 coupon.

Are you from Brazil? Use this R$150 coupon.

Google AdWords: You can get a free $100 AdWords coupon here or here. A couple options linked, as some of their coupon offers expire over time & we update this page periodically.

See below for localized coupons by country in alphabetical order, along with instructions for how to find coupons for countries that are not listed.

Are you from the United States? Use this link.

Are you from the United States? Use this link. Are you from Argentina? Use this link.

Are you from Argentina? Use this link. Are you from Australia? Use this link.

Are you from Australia? Use this link. Are you from Austria? Use this link.

Are you from Austria? Use this link. Are you from Belgium? Use this link.

Are you from Belgium? Use this link. Are you from Canada? Use this link.

Are you from Canada? Use this link. Are you from Estonia? Use this link.

Are you from Estonia? Use this link. Are you from Finland? Use this link.

Are you from Finland? Use this link. Are you from France? Use this link.

Are you from France? Use this link. Are you from Germany? Use this link.

Are you from Germany? Use this link. Are you from Hong Kong? Use this link.

Are you from Hong Kong? Use this link. Are you from India? Use this link.

Are you from India? Use this link. Are you from Indonesia? Use this link.

Are you from Indonesia? Use this link. Are you from Ireland? Use this link.

Are you from Ireland? Use this link. Are you from Israel? Use this link.

Are you from Israel? Use this link. Are you from Italy? Use this link.

Are you from Italy? Use this link. Are you from Japan? Use this link.

Are you from Japan? Use this link. Are you from Korea? Use this link.

Are you from Korea? Use this link. Are you from Latvia? Use this link.

Are you from Latvia? Use this link. Are you from Malaysia? Use this link.

Are you from Malaysia? Use this link. Are you from Mexico? Use this link.

Are you from Mexico? Use this link. Are you from the Netherlands? Use this link.

Are you from the Netherlands? Use this link. Are you from New Zealand? Use this link.

Are you from New Zealand? Use this link. Are you from Norway? Use this link.

Are you from Norway? Use this link. Are you from the Philippines? Use this link.

Are you from the Philippines? Use this link. Are you from Poland? Use this link.

Are you from Poland? Use this link. Are you from Portugal? Use this link.

Are you from Portugal? Use this link. Are you from Russia? Use this link.

Are you from Russia? Use this link. Are you from Saudi Arabia? Use this.

Are you from Saudi Arabia? Use this. Are you from Singapore? Use this link.

Are you from Singapore? Use this link. Are you from Slovenia? Use this link.

Are you from Slovenia? Use this link. Are you from South Africa? Use this link.

Are you from South Africa? Use this link. Are you from Spain? Use this link.

Are you from Spain? Use this link. Are you from Sweden? Use this link.

Are you from Sweden? Use this link. Are you from Taiwan? Use this link.

Are you from Taiwan? Use this link. Are you from Thailand? Use this link.

Are you from Thailand? Use this link. Are you from the United Arab Emirates? Use this link.

Are you from the United Arab Emirates? Use this link. Are you from the UK? Use this link.

Are you from the UK? Use this link. Are you from the United States? Use this link.

Are you from the United States? Use this link.- Are you from a country not listed above? Use the following link format

http://www.google.fr/adwords/coupons/

simply replace the FR part above with whatever your local Google URL is.

Additional opportunities for obtaining AdWords coupon codes:

- You can contact Google support online here or call AdWords support at 877-906-7955 and ask for coupons.

- The Google Partners Program also offers coupons to consultants managing AdWords accounts.

- Web hosts, financial institutions & other B2B companies may have exclusive promotions for their customers. Check to see if your web host has any custom offers.

- Google Grants offer non-profits up to $10,000 in free AdWords advertising each month.

Why do Advertisers Spend Billions on Paid Search?

Search ads are easy to target, track, and measure - which make them extraordinarily profitable. Advertisers keep buying more PPC ads because they work, which is why search marketing has grown from $108.5 million to a $16.1 billion industry in about a decade. (Those numbers are US-only, and Google gets over half of their ad revenues from international markets).

The growth has only continued since 2011, with Google recording over $95 billion in ad revenues in 2017. In the fourth quarter of 2018 Google had $32.6 billion in ad revenues - averaging over $10 billion per month.

With the above coupons you get to enter the paid search market using free money.

The Dirty Secret of Paid Search Ads

Many affiliate marketers tell you that you need to register at every search engine in the world such that they can get commission from you as you burn your ad budget on low quality traffic.

But the truth is that for most of the world (outside of a few countries like China, South Korea & Russia) there are only 3 search-related companies you must buy traffic from: Microsoft, Yahoo!, and Google.

Each of these search services has abundant high quality traffic sources

- Google is the most widely known & most widely used search engine. They own the Google Chrome web browser, bundle Google services in the Android mobile operating system, pay to be the default search provider on web browsers like Opera & Mozilla's Firefox, and on Apple Safari web browser on devices like iPhones, iPads & Macbooks. They also power the search ads on sites like Ask.com & Earthlink, in addition to owning YouTube and delivering ads on many newspapers and ecommerce sites.

- Microsoft owns Internet Explorer & Microsoft Edge, the default web browsers built into Windows, the most widely used desktop computer operating system. Microsoft promotes Bing in Internet Explorer & Microsoft Edge browsers, as well as in Windows 10. Bing Ads appear on Bing search results, as well as on Yahoo! Search results and AOL search results.

- Yahoo! is a leading web portal with significant traffic. People using their email addresses or other services often conduct searches at Yahoo! Search while on the site. Yahoo! also bundles search default placement in agreements with companies like Oracle on Java updates.

Since Yahoo! Search outsourced their algorithmic search results to Bing and PPC search ads to Bing Ads (formerly known as Microsoft adCenter), you only need to buy search ads on 2 platforms to reach over 90% of searchers in most countries. There are only a few exceptions where other search providers dominate local markets. Those exceptions include Baidu in China, Yandex in Russia & Naver in South Korea.

Only the Big 3 Search Engines Matter to Advertisers

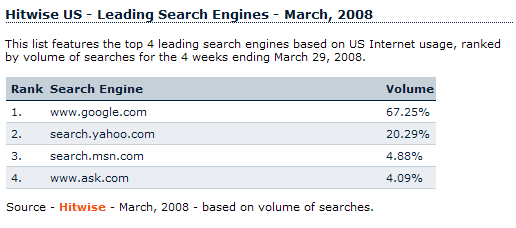

Are there other PPC networks? Yes. But most of them do not have a large clean source of traffic. Have you ever performed a search on the smaller search ad networks like Miva, Looksmart, SearchFeed, GoClick, ABC Search, Search123, or 7Search? Most web users probably have not. In fact, here is a graph of search share in the United States from HitWise from a decade ago:

Notice how 96.51% of search queries were consolidated amongst the top 4 search engines. Google syndicates ads to Ask.com & Microsoft's ads are syndicated to Yahoo!, so you really only need to buy in on 2 engines to access over 90% of US based search queries!

In the decade since the above image was created, search query volume has only become more consolidated, which is why:

- FindWhat & Espotting merged, rebranded into Miva, then were sold off with the rest of Miva's media division to AdKnowledge for only $11.6 million. Before Google went public, FindWhat by itself was worth $350 million.

- ValueClick announced divestiture of Search123 for a non-material amount

- GoClick redirects to Marchex. Marchex is primarily focused on call tracking & local lead solutions. Marchex also sold off their domain portfolio, which included some names they paid $164 million for, to domain registrar GoDaddy for $28 million.

- Looksmart's stock traded below $1 a share, when on a reverse split adjusted basis their stock peaked out at over $200 a share. They merged with a Greek shipping company.

- ABCSearch.com no longer resolves & in 2009 rebranded as Advertise.com

- Searchfeed.com no longer resolves

- Other newer consumer web search companies like Cuil, Wikia Search & Blekko have quickly came and went.

- Among the newer search services only DuckDuckGo appears to have staying power, but they syndicate ads from Google and Microsoft.

- etc etc etc

What About New Search Engines?

While the second and third tier search players have fallen off, most new general purpose web search engines which have been launched (like DuckDuckGo) syndicate ads from either Google or Microsoft.

In January of 2019 Verizon Media Group agreed to have Bing Ads power 100% of their search ads across Yahoo! & AOL. When the deal was announced Bing stated that by March of 2019 advertisers could see 10% to 15% more search ad clicks across the Bing Ads network.

Previously Yahoo! carried Google product listing ads & is sold some of their own search ads via Gemini.

Current Yahoo! Gemini coupon codes:

- The promo code YAHOOADS offers advertisers a free $50 credit.

- The promo code ADSHOP offers advertisers a free $50 credit.

- The promo code WELCOME offers advertisers a free $25 credit.

Originally Gemini was mobile only & mobile clicks are typically not worth as much as desktop clicks due to major conversion issues on mobile devices. However, when Yahoo! renegotiated the search deal with Bing in 2015, they created a carve out in the deal which allowed Yahoo! to sell their own desktop search ads on up to 49% of their search results. After the 2019 deal Gemini ads will focus on display & contextual ad listings while winding down the Gemini search ad business.

In the past Bing highlighted their relative click volume within the Yahoo! Bing network, but they stopped sharing that data a couple years ago. While Bing does not share the data directly, a performance marketing firm named Merkle puts out a quarterly internet marketing report which has highlighted

- Google dominates mobile search marketshare & their dominance of mobile increases their overall search marketshare beyond the already dominant position they have in desktop search

- in spite of Gemini existing for many years, it hasn't grown in share for years (in most cases Yahoo! likely makes more selling ads from Bing or Google & paying the associated TAC rather than selling ads direct)

- while Bing's share of the search market has held quite steady, Yahoo! keeps seeing shrinking marketshare

- any acceleration in click growth from Bing or Yahoo! has typically been due to increasing ad load in the search results rather than gaining significant search marketshare

It is worth mentioning mobile clicks are valued much lower than desktop clicks due to a higher incidence of accidental clicks and how much harder it is to perform many forms of conversion on a mobile device than on a tablet or desktop computer. Google tried to prop up mobile click prices by rolling out "Enhanced Campaigns," but ultimately they failed to drive mobile click prices higher for years. Here's a recording of a beligerent AdWords "support" person who was angry at a "stupid" advertiser for upgrading to Enhanced campaigns early without talking to his Google Account Manager.

A category-leading company like Amazon.com can afford to bid higher for mobile traffic than most other ecommerce players in part because so many people already have Amazon.com accounts and do so much of their online buying on Amazon.com.

Social media sites like Facebook, Instagram, Twitter, LinkedIn, Snapchat & Pinterest have risen as popular destinations with a large stream of traffic, but in most cases those channels tend to be more aligned with either top of funnel awareness/branding or retargeting/remarketing rather than being high intent channels where an advertiser can insert themselves into the value chain near the end point of the transaction (like they can with search ads). It is also worth mentioning the search ad networks also have display ad features which allow remarketing on their networks.

While clicks on social platforms and mobile devices often tend to have a somewhat limited value, one of the highest intent traffic streams outside of search engines is on Amazon.com. In fact, even Eric Schmidt stated Amazon is Google's biggest competitor:

Our biggest search competitor is Amazon. People don’t think of Amazon as search, but if you are looking for something to buy, you are more often than not looking for it on Amazon

Here is a $50 Amazon.com ad coupon, which is also linked to below.

Coupon Codes You Can Use Today to Save Money

These coupons are only good for new customers.

Bing Ads: get a free Bing coupon today to run PPC advertisements on Bing and Yahoo! Search. Are you from the United States? Use this $100 coupon.

Are you from the United States? Use this $100 coupon.  Are you from Canada? Use this $50 coupon.

Are you from Canada? Use this $50 coupon. Are you from the UK? Use this £50 vouchers.

Are you from the UK? Use this £50 vouchers. Are you from Germany? Use this €50 coupon.

Are you from Germany? Use this €50 coupon. Are you from France? Use this €50 coupon.

Are you from France? Use this €50 coupon. Are you from Italy? Use this €50 coupon.

Are you from Italy? Use this €50 coupon. Are you from Spain? Use this €50 coupon.

Are you from Spain? Use this €50 coupon. Are you from Australia? Use this $50 coupon.

Are you from Australia? Use this $50 coupon. Are you from New Zealand? Use this $50 coupon.

Are you from New Zealand? Use this $50 coupon. Are you from India? Use this ₨1000 coupon.

Are you from India? Use this ₨1000 coupon.  Are you from Mexico? Use this $670 coupon.

Are you from Mexico? Use this $670 coupon. Are you from Brazil? Use this R$120 coupon.

Are you from Brazil? Use this R$120 coupon.

Google AdWords:- You can get a free $75 AdWords coupon here (or here or here or here) ... many options linked, as some of their coupon offers expire over time & we update this page periodically. The Google Partners Program also offers coupons to consultants managing AdWords accounts.

Yahoo! Gemini:- Click here to set up your Yahoo! Gemini advertiser account. Enter the code YAHOOADS to get a free $50 bonus. In addition to running high-intent search ads, you can run other Yahoo! ad units like the native stream ads running on their homepage & retargeted ads.

Amazon Product Ads- You can use the following coupon to get $50 worth of free ad clicks from Amazon.com. This coupon is good for ads for merchants wanting to sell products on Amazon.

Gain a Competitive Advantage Today

Your top competitors have been investing into their marketing strategy for years.

Now you can know exactly where they rank, pick off their best keywords, and track new opportunities as they emerge.

Explore the ranking profile of your competitors in Google and Bing today using SEMrush.

Enter a competing URL below to quickly gain access to their organic & paid search performance history - for free.

See where they rank & beat them!

- Comprehensive competitive data: research performance across organic search, AdWords, Bing ads, video, display ads, and more.

- Compare Across Channels: use someone's AdWords strategy to drive your SEO growth, or use their SEO strategy to invest in paid search.

- Global footprint: Tracks Google results for 120+ million keywords in many languages across 28 markets

- Historical performance data: going all the way back to last decade, before Panda and Penguin existed, so you can look for historical penalties and other potential ranking issues.

- Risk-free: Free trial & low monthly price.